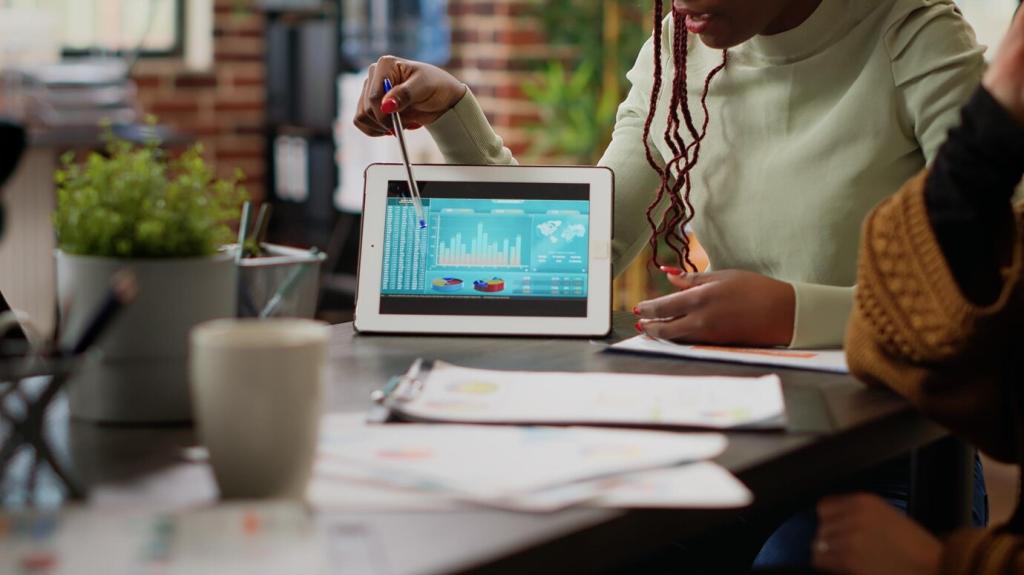

Machine learning is transforming the landscape of stock analysis by enabling analysts, traders, and investors to extract significant predictive insights from vast amounts of market data. This transformative technology automates data-driven decision-making processes, enhances forecasting accuracy, and uncovers subtle patterns that would otherwise be missed by traditional analytic methods. As financial markets generate increasingly complex and high-frequency data, machine learning techniques play a crucial role in identifying investable opportunities, managing risk, and optimizing trading strategies. This page provides an in-depth exploration of the most influential machine learning techniques shaping contemporary stock analysis, their practical applications, the challenges associated with their deployment, and their impact on the future of finance.

Foundations of Machine Learning in Stock Analysis

Multi-Layer Perceptrons in Price Forecasting

Recurrent Neural Networks for Sequential Data

Convolutional Neural Networks in Pattern Recognition

Ensemble Methods and Model Combination

Boosting Algorithms for Enhanced Predictive Accuracy

Natural Language Processing in Financial Sentiment Analysis

Sentiment Analysis for Market Mood Detection

Event Detection and Impact Assessment

Topic Modeling for Trend Discovery

High-Frequency Trading Strategy Optimization

Adaptive Portfolio Allocation

Execution Algorithms and Market Impact Reduction

Challenges and Limitations of Machine Learning in Finance

Overfitting and Model Robustness